A Biased View of Succentrix Business Advisors

Wiki Article

Fascination About Succentrix Business Advisors

Table of ContentsThe Main Principles Of Succentrix Business Advisors The Best Guide To Succentrix Business AdvisorsNot known Factual Statements About Succentrix Business Advisors Get This Report about Succentrix Business AdvisorsThe Best Guide To Succentrix Business Advisors

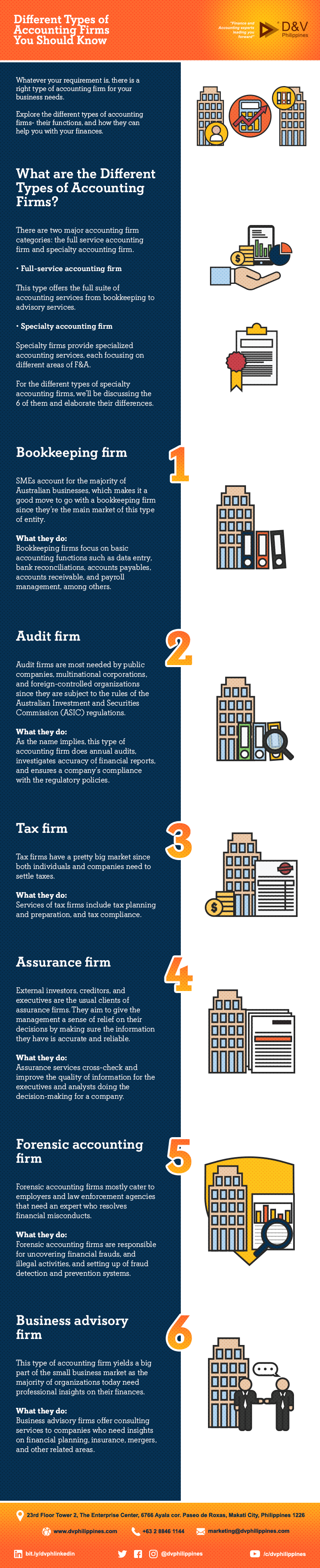

That's where these accountants are available in. Interior bookkeeping supplies management and the board of supervisors with a value-added service where problems in a process may be caught and dealt with. This is very important for securing corporations from liability for scams too. The Sarbanes-Oxley Act of 2002 - https://vermilion-corn-l4dbs4.mystrikingly.com/blog/professional-accounting-and-tax-services-succentrix-business-advisors set brand-new corporate bookkeeping standards and enforced severe criminal charges for financial fraudTax obligation audit is most likely the most common audit service made use of by exclusive individuals. Tax obligation accountants concentrate on preparing tax returns and aiding people and services submit their kinds and pay their taxes. Tax obligation law is endlessly made complex and frequently transforming, so accountants have to remain up-to-date on every one of the rules and laws.

Forensic accountancy is regarding examination and lawsuits assistance. This solution is usually involved with suits and claims of scams, embezzlement, or money laundering.

The Main Principles Of Succentrix Business Advisors

Accounting is about preserving exact and comprehensive records. This is the bread and butter of accounting. It includes keeping track of all inputs and outcomes and double-checking every little thing to make sure it's been correctly videotaped.After that when it's time to apply for taxes or use for a finance, a bookkeeper can generate a financial statement just by placing with each other the economic records for a provided duration of time. One of the reasons specialist accounting solutions are so important is as a result of human error. Any procedure run by people is mosting likely to make errors.

That's where bank reconciliation is available in. Financial institution settlement is a process of examining and contrasting - https://succentrix-business-advisors.webflow.io/ your financial documents to those of your bank and repairing errors if the records do not match the way they're meant to. You refine payments and after that down payment those settlements in the bank. If your documents are precise, your payment records ought to perfectly match the bank's document of down payments.

Excitement About Succentrix Business Advisors

Accounts payable is a classification that consists of future expenses as well, which assists you plan. Professional Accounting and Tax services.You might not be able to obtain that cash money immediately, yet you can intend future expenditures based on the anticipated in-flows from those accounts receivable. The category of receivables on a basic ledger is essential since it allows you look ahead and strategy. The even more informed you have to do with your firm's economic scenario, the much better ready you are to readjust and adjust as needed.

Managing a regular pay-roll and documents can occupy a great deal of effort and time, even for a local business without way too many workers. Accounting professionals work with services to arrange and automate pay-roll systems to work far better for both employers and employees. Audit services pertaining to pay-roll can include gathering employee info, developing a time-tracking system, and taking care of the real handling of repayments to team.

The 15-Second Trick For Succentrix Business Advisors

Many business owners collaborate with accounting professionals as they develop organization plans, also prior to the organization has been established (tax advisory services). Accountants can be useful partners in building an engaging business plan and discerning which company entity is appropriate for the owner's vision. Accountants can aid a local business owner choose a company name, gather firm info, register for a company recognition number, and register their firm with the state

Accounting services have to do with improving document processes and producing information to equip you much better to grow your organization and realize your vision.

The Main Principles Of Succentrix Business Advisors

The reality that a lot of companies include the precise very same compliance summary on customer billings enhances that there is nothing special about the compliance report. On the other hand, the suggestions, proficiency, planning and method that went right into the procedure before the record was produced are extremely set apart.Advisory supports specialization, which results in higher-value services and splitting up from the sea of generalists. If we can't verbalize our advisory experience, it's an assurance that clients will not be able to untangle our compliance solutions from higher-value advising solutions. The AICPA defines advising solutions as those services where the professional "establishes findings, final thoughts, and recommendations for client consideration and choice production." AICPA additionally offers examples of advising services that consist of "an operational review and enhancement research, evaluation of a bookkeeping system, support with tactical preparation, and interpretation of requirements for an information system." This is useful, however this definition really feels more official and narrower than how professionals define consultatory solutions in their firms.

Report this wiki page